Every industry including banking sector is facing a major transformation with the introduction of enterprise mobility technology. Among all the technologies that are making financial world on a roller-coaster ride, mobility is the one that is bringing in the most critical changes throughout the sector. It includes banks and other financial organizations in the list.

All the organizations are making tremendous efforts to ensure that customers can handle and take care of their capital market, wealth management, banking or e-commerce transactions on any type of mobile device, on demand, from any location. Customers are investing their hard-earned money to grow with effective and reliable financial services and they want to control their funds completely.

With the introduction of mobility solutions in the financial sector, all traditional methods used by the industry have dissolved. This brings a great change in the working plan used by the industry.

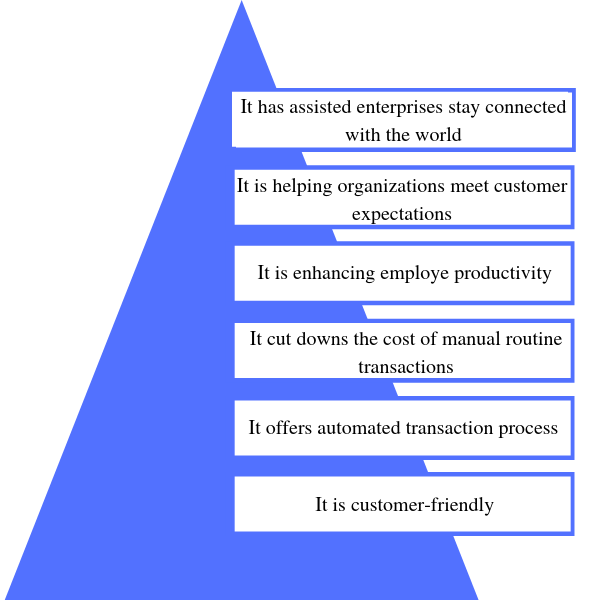

Fig – Showing the benefits offered by mobility to banking sector

Enterprise mobility is mobilizing the enterprise systems to allow employees to execute their routine tasks anywhere, anytime through mobile devices. Enterprise mobility offers workforce with real time accessibility to business critical data. It offers better coordination between employees for enhanced productivity and design making process. It executes business operations with mobility. It offers competitive edge to mobile users by allowing them to perform digital signature capturing, payment processing, stock management, and real time dashboard based apps tracking significant operations in business. It also allows customers to access customer centric information anytime, from anywhere.

Why enterprise mobility matter? What is its significance?

Whenever there is a transformation in the trend and user behavior, organizations that could easily go through the transformation survive.

Mobilized enterprise data becomes intelligent, read further to know how-

- With the introduction of new device capabilities the data collected from the users are contextual

- The smart data includes attributes like geo location, connectivity/availability, user activity

- Contextual data allows contextual intelligence with inputs from user, device, and environment

Future Trends of Enterprise Mobility

Customize enterprise mobile apps development is becoming the great factor that helps leading the way in future and allowing corporate sector companies to stay ahead with enhanced efficiencies. Enterprise app Development Company needs to act in accordance with the following future trends in following –

- More adoption of BYOD (Bring Your Own Device) – More and more companies are requesting their employees to bring and use their own devices for work. It reduces maintenance costs. When the devices of employees get the enterprise version of different apps, it will call-off the restrictions of any risks.

- AI is on the rise – AI is being extensively used in most industries, now including banking. The focus has been shifted to ML and automation in several business operations.

- Enhanced security model – As employees bringing their personal devices, the need of maintaining high security via multi-layered security models arises. Organization needs to provide protection to its most valuable data and other assets from stealing.

- Cloud migration – Storing data on the cloud is common today. Using internet, employees are able to access and make use of data with their mobile devices. Cloud migration is expected to be the future thing that will be used by employees for storing data.

- Less computing and more mobility – Mobile phone users are increasing, and so the demand for enterprise-based app solutions as well. Mobile devices are replacing the traditional laptops and computers at faster rate.

- Demand for location-based services is on the rise – Since users are getting used to of technology, accessing smart mobile devices for searching and choosing local businesses that offer their requested services is on rise.

What will the future of the banking look like?

Ease of operations, incredible user experience and stout security are going to be the major sections of mobile banking. Banks will need to be where its customers are. App based smartphone banking will be emerged as banking channels. Virtual assistants like Alexa, Cortana, Siri, and Echo, and virtual reality tech-innovations like Oculus are responsible feasibility of virtual reality banking option to personal banking. Digital staff of the banks believes in a digital approach that focuses on customer experience, convenience, and meets customer requirements in most efficient way.

Artificial Intelligence will power insights, data, and analytics; which eventually help banks in understanding the customer base better. Many banks in the market have already started implementing ways in which offers, interactions, product recommendations and advisory can be customized to meet the specific requirements and profile of every customer.

Artificial intelligence will work on customer experience and power all functions of the bank in order to deliver an extraordinary customer experience and manage core functions with great efficiency. Banks will also see the emergence of chatbots powered by AI that facilitate banking transactions via social media.